new mexico gross receipts tax rate

The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. Use a Tax Rate Table.

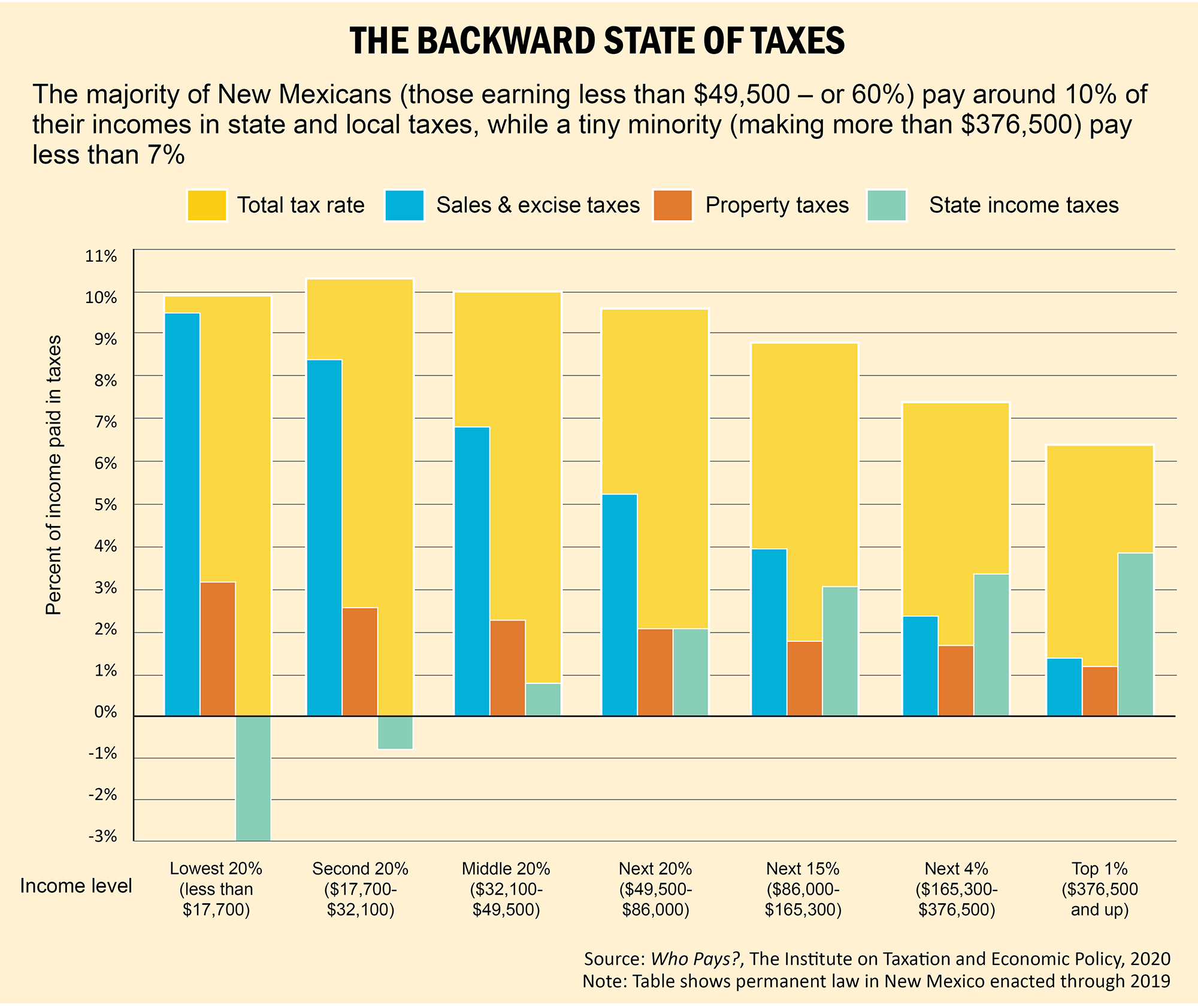

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

The maximum local tax rate allowed by New.

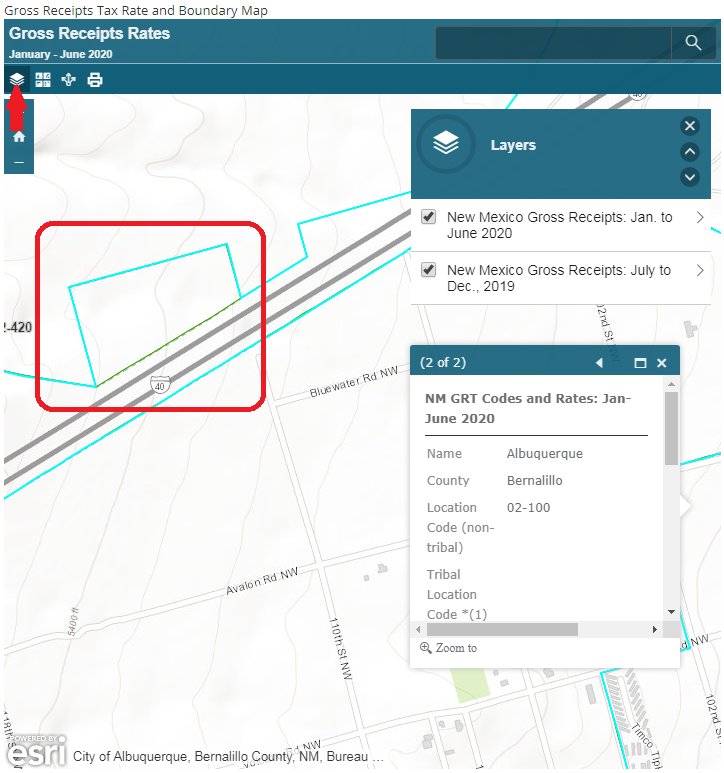

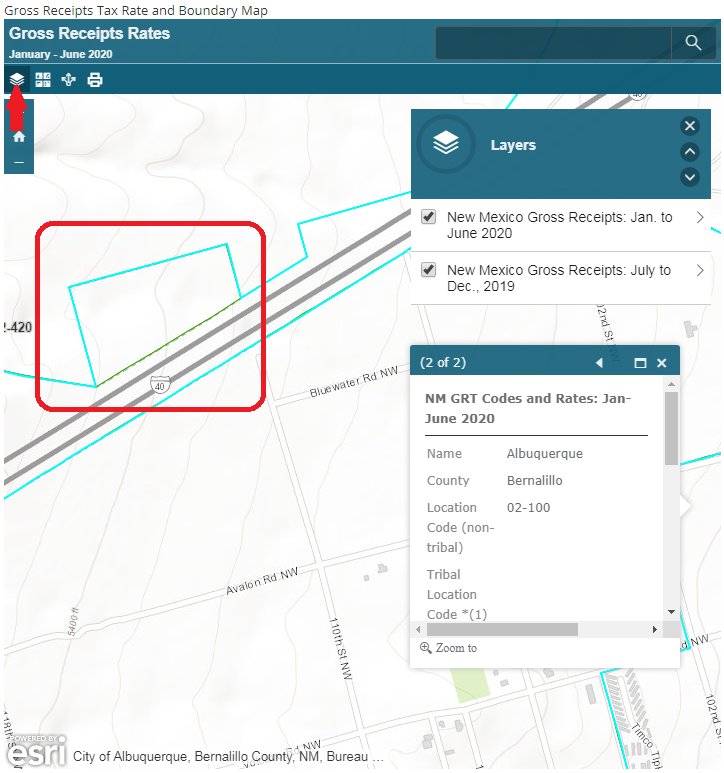

. The changes to the GRT came primarily in response to the US. The business pays the total gross receipts tax to the state which then. The Gross Receipts map below will operate directly from this web page but may also be launched from the Departments Web Map Portal portal link located below the map.

Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. What is the New Mexico gross receipts tax. Submit Current Contact Information.

The business pays the total gross receipts tax to the state which then. These new districts include the following. Location Codes have also been added for four water and sanitation districts created in 2008 when voters within those districts approved the imposition of the one-fourth percent county local option water and sanitation gross receipts tax.

What is the gross receipts tax rate in Albuquerque NM. The business pays the total Gross Receipts Tax to the state which then distributes the counties and. New Mexico Gross Receipts Quick Find is available.

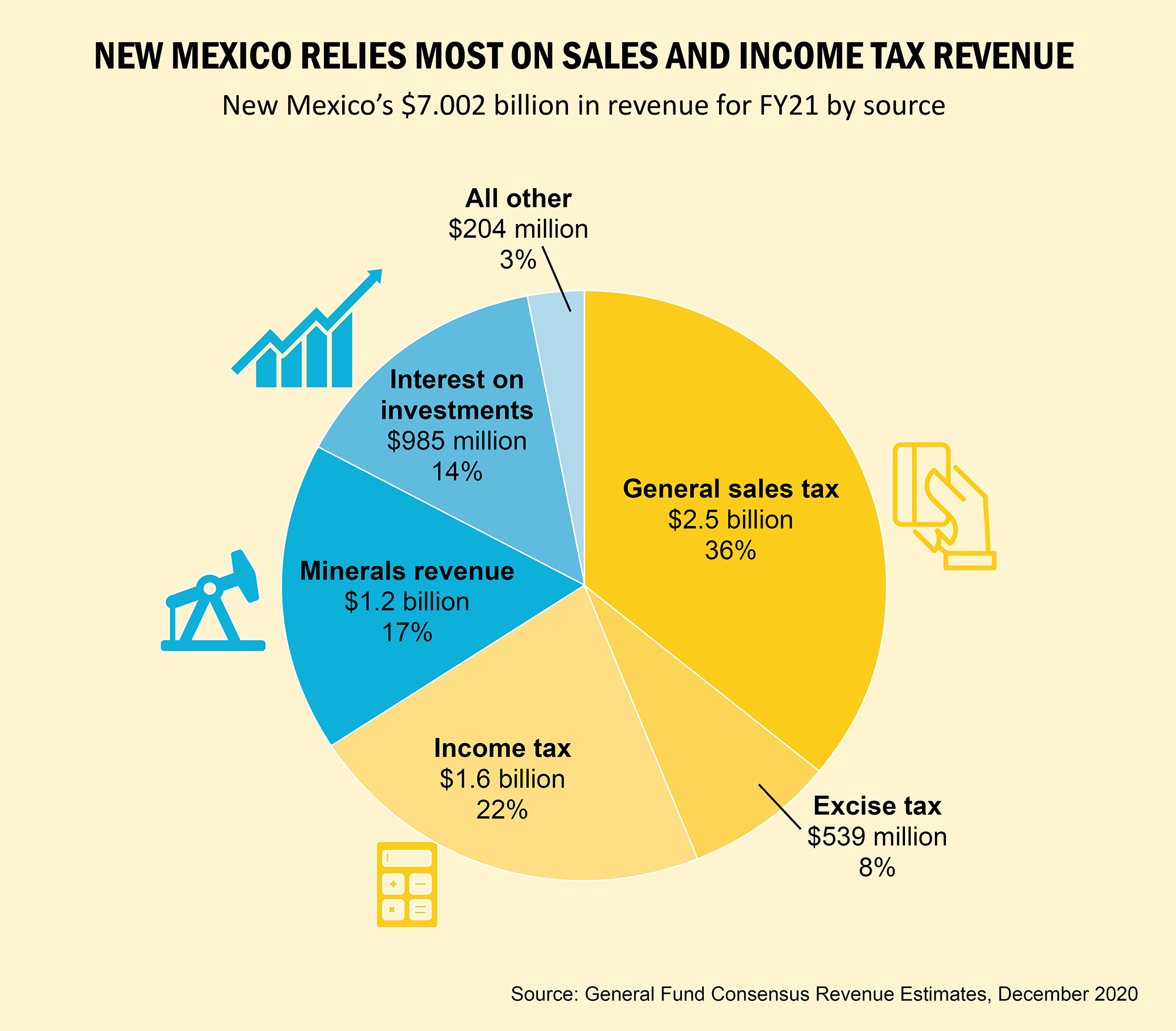

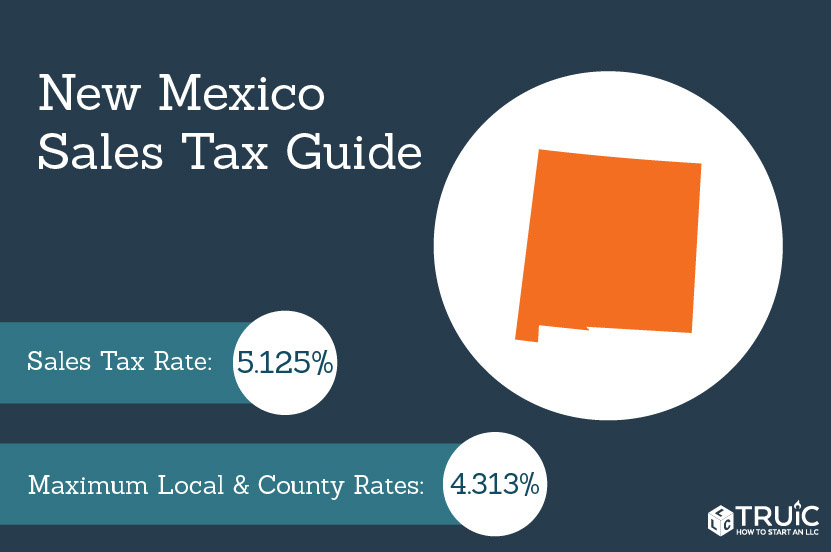

In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the. Other states have franchise taxes which are similar to income taxes. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375.

Supreme Court decision in South Dakota v. Pay Parking Citations Excavation Barricade Permits Health Permit Renewal Alarm Fees. And 12 New Mexico Taxpayer Bill of Rights.

Gross Receipts Location Code and Tax Rate Map. View the current Gross Receipts Tax Rate Schedule. On April 4 2019 New Mexico Gov.

State income taxes range from 10 to 29 in the state. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Since 2019 internet sales have been taxed using the statewide 5125 rate.

New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257. Albuquerque 02-100 78750 Texico 05-302 75625 Edgewood Bernalillo 02-334 78750 Remainder of County 05-005 61250. Corporate Income Franchise Tax.

The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. Combined with the state sales tax the highest sales tax rate in New Mexico is.

New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933. Gross Receipts Tax Rate Schedule. Counties and cities can charge an additional local sales tax of up to 3563 for a maximum possible combined sales tax of 8693.

Liquor Pawnbroker License Holders. Municipality or County Location Code Rate. New Mexico does not have its own sales tax.

The gross receipts tax doesnt deduct expenses. In-State Veteran Preference Certification. GROSS RECEIPTS AND COMPENSATING TAX RATE SCHEDULE Effective January 1 2022 through June 30 2022 Municipality or County Location Code Rate.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Gross Receipts Tax Compensating Tax Sales Use Tax. 6 - Form TRD-41413 Gross Re-ceipts Tax Return and Schedule A 1 - Form 41413 Gross Receipts Tax Business-Related Tax Credit Sched-ule CR and Supplemental Schedule CR GRT payment voucher instructions and 7-GRT-PV.

Anything over 5125 percent represents local option rates imposed by counties and municipalities. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2257 for a total of 7382 when combined with the state sales tax. Albuquerque Metro Area Gross Receipts Tax range.

It has its own tax called the gross receipts tax which is passed largely to consumers as part of its normal business tax. The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735. Starting July 1 those businesses will pay both the statewide rate and local-option Gross Receipts Taxes.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. Of that amount 5125 is the rate set by the stateGross Receipts Tax Rate. 6375 8675 City of Albuquerque Gross Receipts Tax rate.

10 Your Rights Under the Tax Law. Only in its effect on the buyer does the gross receipts tax resemble a sales tax. NM Business Taxes.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Most New Mexico -based businesses starting July 1 must now also use destination sourcing. There are a few ways to determine the proper location code.

Pawn Second Hand Precious Metal Dealers Permits. Compensating tax is an excise tax imposed on persons using property or services in New Mexico also called use tax or buyer pays. Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the proper amount of Gross Receipts Tax is computed and collected by the title company.

Click here for a larger sales tax map or here for a sales tax table. How to use the map. Groceries are exempt from the New Mexico sales tax.

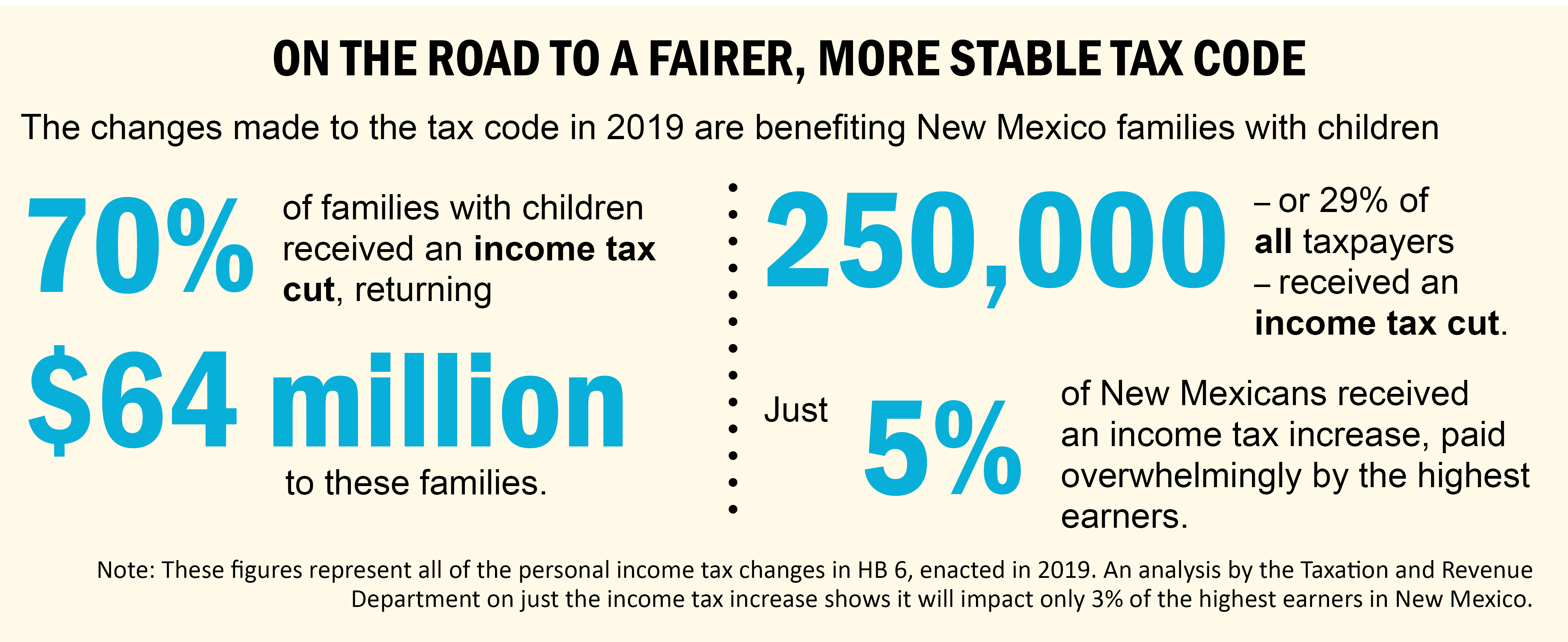

In addition House Bill 163 cuts the states gross receipts tax rate by an eighth of a percent starting July 1 2022 and ramps up to a quarter-percent reduction on July 1 2023 saving New Mexico businesses and consumers nearly 200 million when fully implemented. The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes.

State of New Mexico Gross Receipts Tax Rates. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. New Mexico has 419 special sales tax jurisdictions with local sales taxes in addition to the.

State S Gross Receipts Tax It S Complicated Resource Tool For Start Up And Small Businesses In New Mexico

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

Gross Receipts Location Code And Tax Rate Map Governments

Gross Receipts Location Code And Tax Rate Map Governments

A Guide To New Mexico S Tax System New Mexico Voices For Children

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

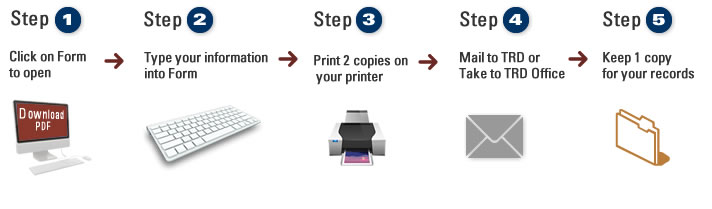

Fill Print Go Taxation And Revenue New Mexico

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Data Suggest N M Still Slogging Toward Recovery Data Infographic Recovery

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

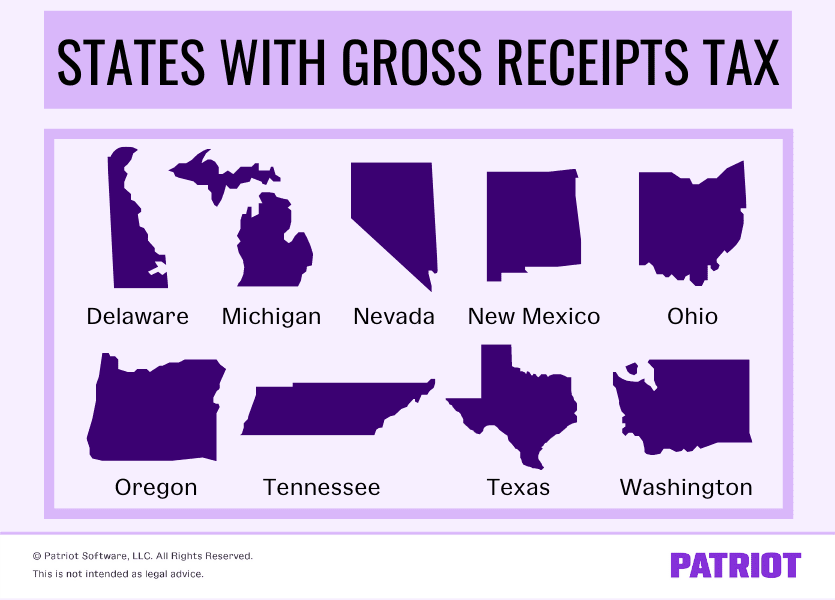

What Is Gross Receipts Tax Overview States With Grt More

A Guide To New Mexico S Tax System New Mexico Voices For Children

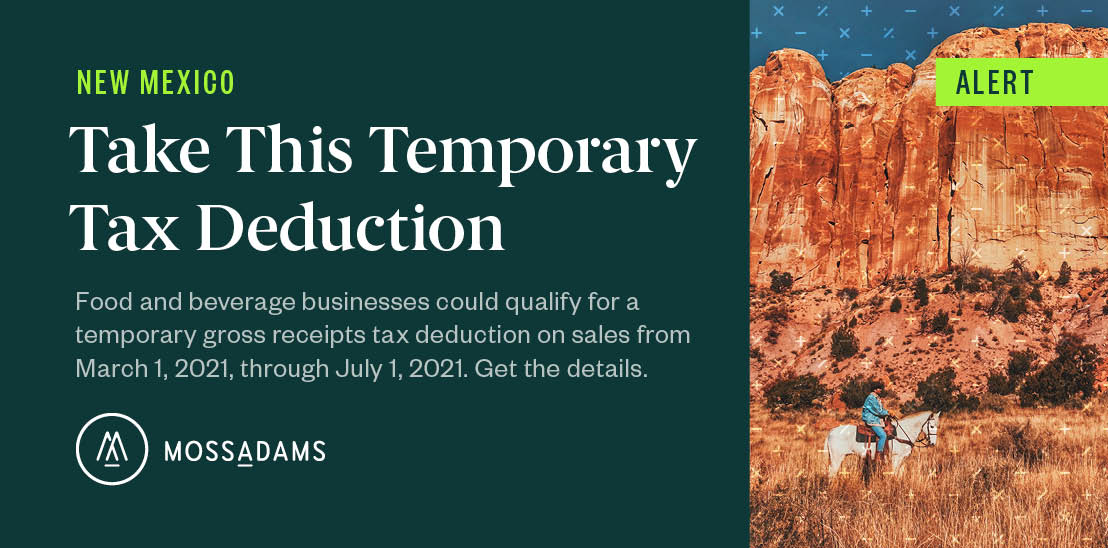

Nm Gross Receipts Tax Deduction For Food And Beverage

What You Should Know About Changes To Nm Tax Reporting Youtube

New Mexico Sales Tax Small Business Guide Truic

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb